Summary

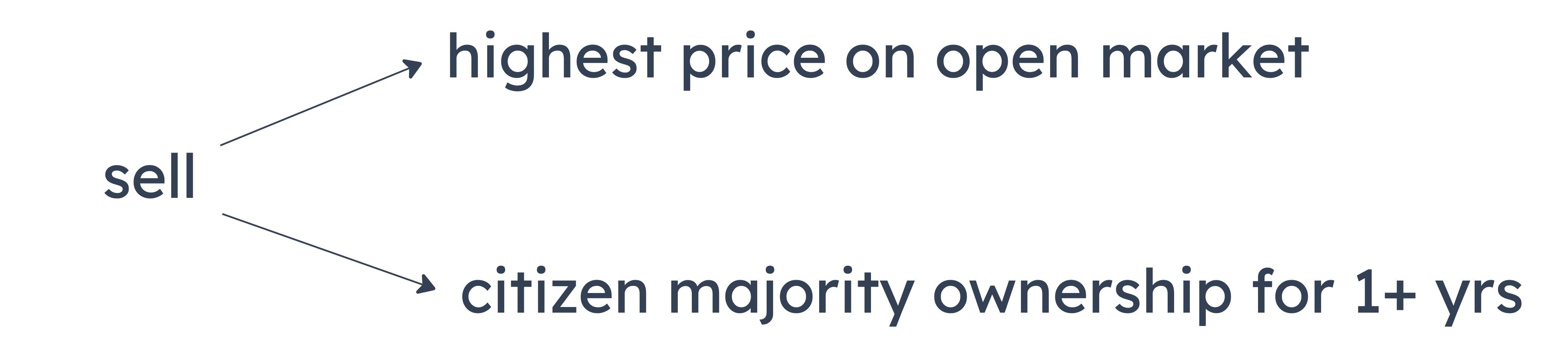

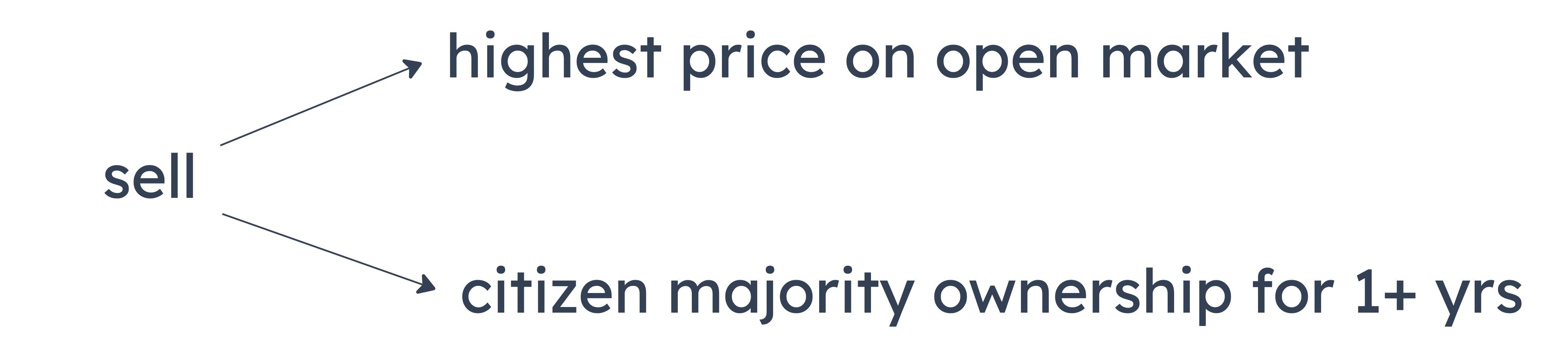

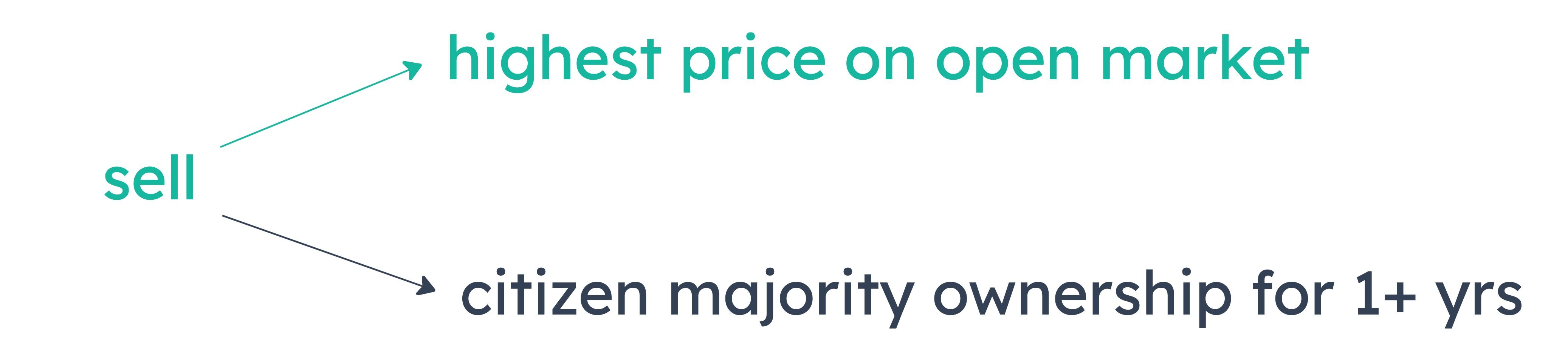

The stimulus can be diagrammed as follows:

Notable Valid Inferences

If the citizens will not have majority ownership for at least one year, then the government should not sell.

If the government is not selling for the highest price on an open market, then it should not sell.

A

The government will sell StateAir, a state-owned airline. The highest bid received was from a corporation that was owned entirely by citizens of Country F when the bid was received. Shortly after the bid was received, however, noncitizens purchased a minority share in the corporation.

This is consistent with the requirements. The corporation in question offered the highest bid for the state-owned airline, and even after noncitizens purchase the share, citizens will still have majority ownership of the company.

B

The government has agreed to sell National Silver, a state-owned mine, to a corporation. Although citizens of Country F have majority ownership of the corporation, most of the corporation’s operations and sales take place in other countries.

This could be consistent with the requirements. This condition meets the requirement of citizens having majority ownership, but we don’t know whether or not the requirement of selling for the highest price was violated.

C

The government will sell PetroNat, a state-owned oil company. World Oil Company has made one of the highest offers for PetroNat, but World Oil’s ownership structure is so complex that the government cannot determine whether citizens of Country F have majority ownership.

This could be consistent with the requirements. It is possible that “one of the highest” means the highest offer, and since the government “cannot determine” if the citizens have majority ownership, we cannot confirm that one of the requirements was violated.

D

The government will sell National Telephone, a state-owned utility. The highest bid received was from a company in which citizens of Country F have majority ownership but noncitizens own a minority share. However, the second-highest bid, from a consortium of investors all of whom are citizens of Country F, was almost as high as the highest bid.

This is consistent with the requirements. The government got the highest bid from a company in which the citizens have majority ownership.

E

The government will sell StateRail, a state-owned railway. The government must place significant restrictions on who can purchase StateRail to ensure that citizens of Country F will gain majority ownership. However, any such restrictions will reduce the price the government receives for StateRail.

This would violate one of the requirements. In this situation, it is impossible to simultaneously meet both of the necessary conditions of selling. If the requirement about citizen ownership is met, the requirement about selling for the highest price must be violated.

Summarize Argument: Phenomenon-Hypothesis

The author concludes that petroleum did not form from deep carbon deposits dating from the formation of the earth. This is based on the fact that petroleum contains biomarkers, which indicate the past or present existence of a living organism.

Notable Assumptions

The author assumes that if petroleum formed from deep carbon deposits, then we would not find biomarkers in it. This overlooks the fact that there might be reasons that biomarkers could be found in petroleum, even if the petroleum formed from deep carbon deposits (as opposed to forming from living things).

A

Fossils have been discovered that are devoid of biomarkers.

Presence of biomarkers indicate past/present life. But that doesn’t mean no biomarkers indicates no past/present life. This doesn’t suggest fossils aren’t connected to life. Also, (A) just means some fossils don’t have biomarkers; the vast majority could have them.

B

Living organisms only emerged long after the earth’s formation.

Petroleum could have formed after those living organisms emerged. The stimulus never suggested petroleum dates to the formation of the earth. It could have come about billions of years afterward.

C

It would take many millions of years for organisms to become petroleum.

Petroleum could have formed many millions of years after organisms emerged. The stimulus doesn’t suggest petroleum dates to the formation of earth. It could have come about billions of years afterward.

D

Certain strains of bacteria thrive deep inside the earth’s crust.

This shows how petroleum might come to contain biomarkers even if it formed from deep carbon deposits. Some bacteria, which is a living organism, could be the origin of the biomarkers. This bacteria is “deep inside the earth’s crust,” which is where “deep” carbon deposits exist.

E

Some carbon deposits were formed from the fossilized remains of plants.

The scientists think petroleum formed from “deep carbon deposits dating from the formation of the earth.” There may be other deep carbon deposits that came after life, such as what (E) describes, but those are different deposits unrelated to the scientists’ view.

Summary

If businesspeople invest in modern industries not yet pursued, then a developing country could increase its economic growth. However, being the first to invest in an industry is risky. Businesspeople have little incentive to take this risk since other investors in the same industry will cut into their profits if the business succeeds.

Strongly Supported Conclusions

If incentives are added for businesspeople to invest in modern industries not yet pursued, then a developing country could increase economic growth.

A

Once a developing country has at least one business in a modern industry, further investment in that industry will not contribute to the country’s economic growth.

This answer is not supported. We don’t know anything from the stimulus if there exists any type of investment that will not contribute to economic growth.

B

In developing countries, there is greater competition within modern industries than within traditional industries.

This answer is unsupported. We don’t know anything about traditional industries from the stimulus to make this comparison. The stimulus is limited to modern industries.

C

A developing country can increase its prospects for economic growth by providing added incentive for investment in modern industries that have not yet been pursued there.

This answer is strongly supported. The stimulus gives us a conditional statement for the prospect of improving economic growth. Since what’s preventing investment is risk, reducing this risk by providing incentives would increase the prospects for economic growth.

D

A developing country will not experience economic growth unless its businesspeople invest in modern industries.

This answer is unsupported. This answer choice reverses the conditional relationship. The stimulus provides that experiencing economic growth is a necessary condition to businesspeople investing in modern industries, not a sufficient condition.

E

Investments in a modern industry in a developing country carry little risk as long as the country has at least one other business in that industry.

This answer is unsupported. The stimulus tells us that there is risk for the first to invest, but we don’t know if there is little risk for subsequent investors. It could be the case that investment is just as risky for them.